|

|

|

State still pursues cigarette tax increase

|

by Mary Helen Yarborough

Public Relations

Despite the recent passage of a law increasing the federal cigarette

tax by 156 percent this spring, the S. C. House of Representatives has

proposed a bill that would increase the state’s cigarette tax

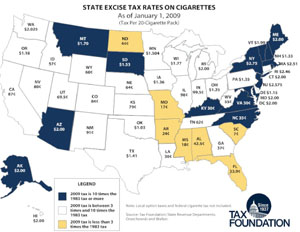

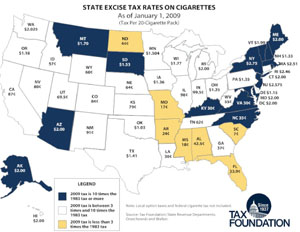

from its current 7-cent per pack, which is the lowest such tax of any

state in the nation.

Introduced in the House Jan. 13, House Bill (HB) 3014 would increase

the tax on tobacco products to 1.85 cents a cigarette or 37-cents per

pack (or 5 percent of the manufacturer’s product price). It also

includes a tax on all tobacco products.

Introduced in the House Jan. 13, House Bill (HB) 3014 would increase

the tax on tobacco products to 1.85 cents a cigarette or 37-cents per

pack (or 5 percent of the manufacturer’s product price). It also

includes a tax on all tobacco products.

The bill, sponsored by Reps. Michael A. Pitts (R-14) and Wendell

Gilliard (D-111), also would assess a 5 percent tax on the baseline

price charged by manufacturers, considering that cigarette makers have

traditionally reduced the product price to adjust for the retail

product price. HB 3014 also would tax all tobacco products including

roll-your-own cigarettes; and assesses a 5 percent tax on the base

price of each product sold. The provides that retailers, distributors

and wholesalers caught stockpiling cigarettes to avoid the higher tax

would be penalized.

The Senate, which has not proposed a cigarette tax increase this year,

would have to vote to approve the House bill; then the governor would

have to sign the final measure before it could become law. Last year,

the House and Senate approved a cigarette tax increase, but Gov. Mark

Sanford vetoed it.

Revenue generated from the cigarette tax increase would allocate

at least $10 million to the Commission on Higher Education to

underwrite nursing education through the Critical Needs Nursing

Initiative Fund. The revenue also would support the Nursing Education

Scholarship Fund, providing scholarships and financial assistance for

qualified in-state applicants.

Beginning with school year 2009-2010, the projected revenue would cover

30 credit hours, fees, books and materials for qualified individuals

seeking either an associate’s or bachelor’s degree in nursing.

Qualified individuals would include South Carolina residents who

graduated from a high school in this state, or whose parent or guardian

served in the U.S. armed forces during the previous four years and paid

income taxes in South Carolina for a majority of their service years.

“The nursing education scholarship, in combination with all other aid,

including federal, state, private, and institutional funds, must not

exceed the total cost of attendance, excluding costs for room and

board, for any academic year,” the HB 3014 states. “The nursing

education scholarship must be awarded only after all other sources of

aid have been exhausted. Adjustments to the financial aid package must

be made to reflect other sources of aid and to prevent an overage.”

The bill has been referred to the House Ways and Means Committee where

members are negotiating other possible provisions, including allowing

the new revenue to fund Medicaid. Health advocates are hoping to see

more of the tobacco tax money fund state-supported health programs that

cigarette smokers are more likely to need.

Meanwhile, President Barack Obama on Feb. 4 signed into law a federal

cigarette tax of $1.01 per pack. The new tax will go into effect April

1 and also significantly increases the tax on roll-your-own tobacco.

The new law is based upon Senate and House approval to increase the

current federal 39-cent tax per pack by 156 percent. This new national

cigarette tax extends the State Children’s Health Insurance Program

(SCHIP), which was established in 1997 to help families earning too

much money to qualify for Medicaid but not enough to afford private

insurance. The cigarette tax authorizes Congress to spend $33 billion

over the next four years to cover 11 million children under SCHIP.

Previously, Congress spent roughly $25 billion for about 7 million

children under the program.

Under SCHIP, states receive an enhanced federal match (greater than the

state’s Medicaid match) to provide this coverage. Each state is

entitled to a specific allotment of federal funds each year and allowed

three years to spend their allotments. After three years, Title XXI

provides that all remaining funds be reallocated to states that have

used up their allotments, which traditionally goes to states with large

populations, such as New York and California.

The S.C. cigarette tax would not be conditioned upon federal

restrictions, which means that other programs also could be funded.

S.C. Speaker of the House Bobby Harrell (R-114) has said that the

enactment of the federal cigarette tax increase would not alter the

legislature’s plan to increase the state’s cigarettes tax.

If revenue drops when smokers quit, tax proponents believe that

state health care dollars would be saved in the long run as

smoking-related illnesses decline. The higher price for cigarettes also

is seen as deterrent to young people and those with limited financial

means.

The House and Senate plan to discuss the issue next week, according to sources.

Cigarette tax could replenish cut state funds

(The

following includes excerpts from a Dec. 10, 2008 letter from Perry V.

Halushka, M.D., Ph.D., professor of pharmacology and medicine, and dean

of College of Graduate Studies and Carola Neumann, M.D., assistant

professor of pharmacology to colleagues. The letter was sent to members

of the South Carolina Senate.)

The steady state funding decline to MUSC during the past eight years

has placed current state funding at 1980s levels. Despite this, MUSC

has adapted to these financial constraints by ensuring excellence in

education, health care and research. In fact, MUSC has grown into a

critical economic resource and institution for the health and

well-being for the citizens of South Carolina. However, the most recent

dramatic budget cuts may significantly endanger the quality of health

care, research and education provided by MUSC.

MUSC holds a unique position among the institutions of higher education

in SC: Despite these financial reductions, MUSC generates $17 for each

state dollar invested via clinical revenues and research grants.

However, recent financial restrictions are beginning to endanger MUSC’s

high quality of health care, research and education. MUSC currently

receives only 40 percent of the Mission Resources Required that the

Commission on Higher Education says it needs. Therefore, MUSC already

is severely under-funded for its education mission as estimated by the

commission.

MUSC also carries the largest financial burden for the treatment of unfunded South Carolinians.

In this current fiscal climate, the state must find new revenues to

support its critical missions—educating its citizens and providing

health care. With a mere 7 cents per pack, South Carolina ranks last

among states in the amount it taxes cigarettes. The national average

cigarette tax exceeds $1 per pack.

The load imposed by inadequately taxed products that result in high

health care costs, i.e. tobacco products, ultimately is passed to the

South Carolina taxpayer in the form of uninsured patients, lost

productivity and a major financial burden.

Certainly, we need to reduce the number of smokers in the state, but it

is time to raise the cigarette tax and use it to provide the financial

resources the state could use to support the education and health of

its citizens.

Friday, Feb. 13, 2009

|

|

|

Introduced in the House Jan. 13, House Bill (HB) 3014 would increase

the tax on tobacco products to 1.85 cents a cigarette or 37-cents per

pack (or 5 percent of the manufacturer’s product price). It also

includes a tax on all tobacco products.

Introduced in the House Jan. 13, House Bill (HB) 3014 would increase

the tax on tobacco products to 1.85 cents a cigarette or 37-cents per

pack (or 5 percent of the manufacturer’s product price). It also

includes a tax on all tobacco products.