|

|

|

Strong push for cigarette tax increase

|

The state should increase its cigarette tax to protect children from

smoking and to shift more of the estimated $1 billion in costs of the

annual tobacco-related diseases back to smokers, said public health

officials at a press conference at MUSC’s Children’s Hospital March 8.

Louis

Eubank, executive director of the South Carolina Tobacco Collaborative,

speaks at a news conference at MUSC's Children's Hospital March 8. Louis

Eubank, executive director of the South Carolina Tobacco Collaborative,

speaks at a news conference at MUSC's Children's Hospital March 8.

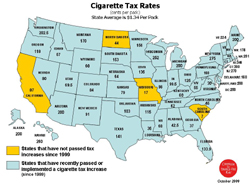

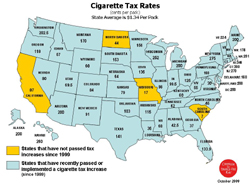

“We’re here today because South Carolina has the lowest cigarette tax

in the nation. Cigarette tax increases have been proven to save lives,”

said Charles P. Darby Jr., M.D., executive director of MUSC’s

Children’s Hospital Center for Child Advocacy. “They make cigarettes

too expensive for many kids to buy and give smokers an added incentive

to quit. The higher the tax, the more lives it would save.”

Darby was one of several speakers during a news conference sponsored by

the South Carolina Tobacco Collaborative, a statewide consortium of

public health organizations, businesses and individuals working to

reduce the toll of tobacco use in the state.

Studies and statistics from other states have repeatedly shown that the

higher the tax the fewer young people become addicted to smoking. It is

usually the teenage child who is introduced to tobacco who then becomes

a lifelong smoker, said Darby.

“Those of us who do not smoke pay higher health insurance premiums and

taxes to subsidize the habit of smoking. It is time the smoker pays for

some of the cost.”

The

state’s 7-cents-per-pack tax is the lowest in the nation, and it hasn’t

been raised since 1977. The national average of state cigarette tax

rates is $1.34 per pack. The state House passed a 50-cent

cigarette tax increase last year that is up for debate in the state

Senate. The

state’s 7-cents-per-pack tax is the lowest in the nation, and it hasn’t

been raised since 1977. The national average of state cigarette tax

rates is $1.34 per pack. The state House passed a 50-cent

cigarette tax increase last year that is up for debate in the state

Senate.

Darby said the state spends more than $393 million a year treating sick

smokers covered under Medicaid. More than 21,000 children under 18 try

a cigarette for the first time each year across the state.

“Raising the tax on cigarettes will be the most significant preventive

health measure for South Carolina in a century,” he said, listing a

variety of smoking-related illnesses, including emphysema and cancer.

“It’s time for South Carolina to do what is right—as a matter of fiscal

policy, but more importantly as a matter of public health.”

Darby said he would urge the Senate to pass an amended bill that would bring the tax up to the national average.

For more info:

The coalition’s campaign to increase the state’s cigarette tax can be found at

http://www.WinWinWinSC.org. For information on the university’s Center for Child Advocacy, visit http://www.musckids.com/about/dept_prog/cca.htm.

Should the state increase the cigarette tax to help pay for health care? Visit

http://www.musc.edu/pr/ and click on Facebook to comment.

Friday, March 12, 2010

|

|

|

The

state’s 7-cents-per-pack tax is the lowest in the nation, and it hasn’t

been raised since 1977. The national average of state cigarette tax

rates is $1.34 per pack. The state House passed a 50-cent

cigarette tax increase last year that is up for debate in the state

Senate.

The

state’s 7-cents-per-pack tax is the lowest in the nation, and it hasn’t

been raised since 1977. The national average of state cigarette tax

rates is $1.34 per pack. The state House passed a 50-cent

cigarette tax increase last year that is up for debate in the state

Senate.